Anyone can make predictions about the next 12 months (who knows – some of their predictions might even come true…) But on the Artemis Positive Future team we prefer to take a slightly bolder approach by looking back on what we are confident will have happened by the end of 2025.

While financial markets are unpredictable in the short term, the initial conditions surrounding us today make a number of developments over the next three years extremely likely. For example…

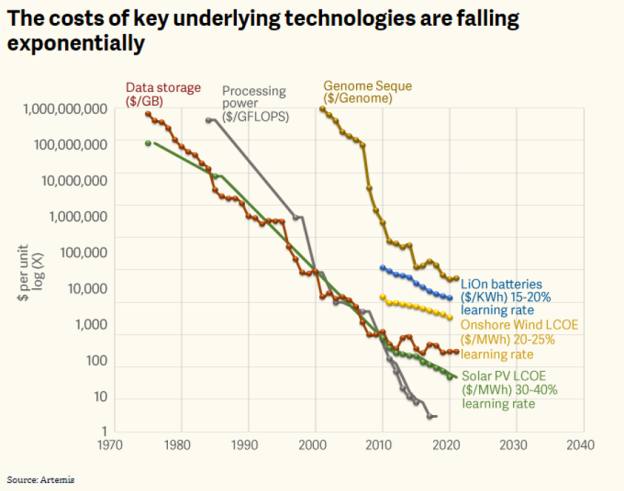

- computing power

- data storage

- solar panels

- wind turbines

- fuel cells

- heat pumps

- genome sequencing and

- battery energy storage

…will continue getting cheaper at highly predictable rates, driven by ‘Wright’s Law’ learning curves.

This is incredibly useful information to investors. It means we can confidently predict that many large and established industries will be disrupted and that most incumbents will struggle to adapt to technological shifts in the basis of competition. We can forecast that many of the companies that are building businesses around these structural transformations will create significant value for their shareholders, regardless of what interest rates are – or where inflation prints come in – over the next three years.

So when we settle back in our armchairs on Hogmanay 2025, put down our iPhone 17s and review three years of fascinating debate about inflation, interest rates and bond yields (all of which will have seemed vitally important to financial markets at the time), what will actually seem important? What will really have changed?

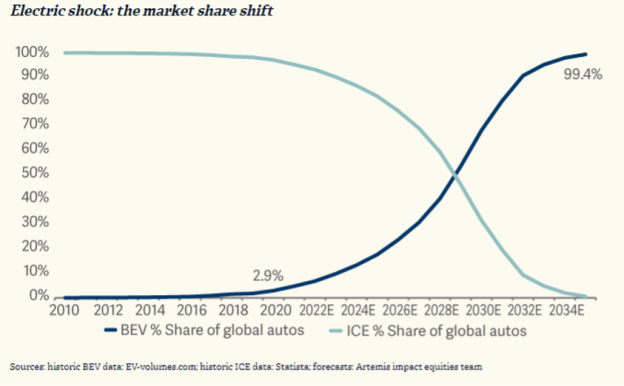

1. Battery electric vehicles become the mainstream choice

Over the next three years, the cost of battery electric vehicles (BEVs) will come close to undercutting those built around internal combustion engines. That is not wishful thinking on our part. Our conviction is based on predictable learning rates which make further increases in the range of BEVs – and a decline in their costs relative to those powered by internal combustion engines (ICEs) – inevitable. As relative costs fall, sales will rise. Like it or not, as ‘cybertrucks’ designed to appeal to America’s appetite for super-sized vehicles begin to roll off the production line – the addressable market for zero-emission vehicles will expand in lockstep.

That will create a negative cycle of diseconomies of scale for legacy auto manufacturers as demand shifts away from their largest source of revenue – combustion engines – and as the factories that make them become structurally underutilised. Companies that fail to pivot to this new drive-chain technology are at high risk of bankruptcy. Companies that are optimised around BEVs – or whose technology underpins infrastructure such as charging stations – have an opportunity to prosper.

2. The ‘artificial pancreas’ starts to offer practical, daily help to diabetics

Over the next three years, emerging and existing technologies will continue to converge, creating new opportunities to solve significant problems facing the global economy such as climate change, lack of access to education – and the daily challenges faced by millions of diabetics.

537 million adults worldwide currently live with diabetes. That is predicted to rise to 643 million by 2030 and to 783 million by 2045. Over $1 trillion is spent on diabetics each year in the US – or one in every four dollars of total healthcare spending. Yet while the outlook may appear bleak, disruptive technology has the power to create positive-sum outcomes…In the absence of an outright cure, technology is on the brink of creating automated devices that will effectively manage diabetes without intervention. These devices will: