Tax management, wellness and estate planning are often not the primary reason for people taking out protection policies, but when advisers can incorporate this into an overall financial plan, it can make a significant difference to clients' health and wealth.

Because life and health policies come with value-added services attached, and the potential to use some policies for tax planning, it makes sense to advise both individual and corporate clients on what these can mean for them and their business.

Not only can these form the basis of good long-term financial planning for individual clients, but also form the foundations of a good employee assistance programme in the workplace through the use of products such as relevant life cover.

As Alan Richardson, protection specialist for LifeSearch, points out: "When I talk to company directors, the sooner we touch upon areas such as tax relief and lower premiums, the better the conversation will be – and the more likely that cover will be arranged."

Value-added services

When extra services and wellbeing bonuses attached to insurance policies were first mooted more than a decade ago, it was seen by some industry commentators at the time as a bit gimmicky.

But as the protection industry has moved on from pure insurance sales towards a focus on the individuals' health and wellbeing, both mentally and physically, the importance of value-added services has grown.

They now cover a "spectrum of support", according to Setul Mehta, head of business development and adviser services at The Openwork Partnership.

Value-added services can include:

- Virtual GPs;

- Bereavement support for children;

- Mental health support;

- Counselling;

- Second medical opinion;

- Physical rehabilitation;

- Return-to-work support;

- Retraining and CV writing skills;

- Discounted gym membership or wearables; or

- Vouchers for healthy food choices, such as Whole Foods.

Mehta comments: "Many of these services come at little extra cost and, in many case, can be use by spouse, partners or children."

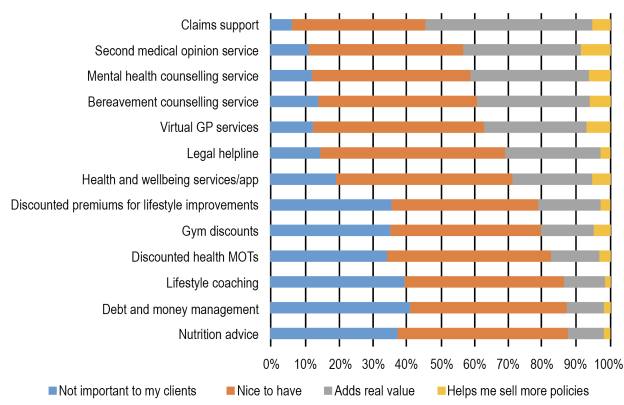

Many of these services had been considered 'nice to have' in a 2019 survey by Defaqto (see graph below), but over the course of the pandemic advisers have spoken of an increased interest from clients in the use of services such as virtual GPs.

For example, as reported by FTAdviser, employee protection and benefits association Group Risk Development (Grid) revealed that the use of online GP services, mental health counselling and second medical opinion services doubled in 2020 and 2021, compared with 2019.

According to Grid's interim Covid-19 Claims Survey 2020 and 2021, interactions with support services rose from 74,707 in 2019 to 138,222 over 2020.

Source: Defaqto

Richardson comments: "The fact-find should identify the overall needs of the client, but that is not always possible.

"People do have other, often subtle or abstract needs that are not initially obvious, so you have to dig in.

"For example, policies that include a virtual GP or second opinion service might not be top of someone's wish-list, but they may be hugely appreciated add-ons."

And for employers building employee assistance programmes, these can be a "tremendous step to understanding the power of EAPs that can improve a company's retention, recruitment, productivity and culture", Richardson adds.

Relevant life policy

It might be worth talking to small to medium-sized employer clients about using relevant life cover instead of providing personal life insurance policies for their staff.