The research, which surveyed 180 UK financial advisers, found that while 77 per cent said their preparations were in progress for the forthcoming deadline on July 31, 4 per cent had not yet started preparing.

Of the four consumer outcomes, assessing and describing fair value was seen as the most difficult to prepare for.

Some 59 per cent of the advisers surveyed said they felt this outcome would put pressure on the ongoing charging model.

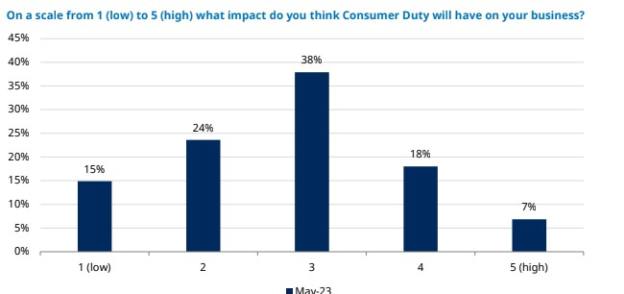

Meanwhile, only a quarter of advisers (25 per cent) said they thought the consumer duty would have an “above medium” impact on their business.

Gillian Hepburn, intermediary solutions director at Schroders, noted that consumer duty continues to be front of mind with advisers.

“Although the majority of advisers report they will be prepared by the end of July, it is surprising to learn that 77 per c ent thought it would only have a medium to low impact on their business. We look forward to exploring this topic further in our next survey in November,” she said.

Economic outlook

Elsewhere, the survey results also showed that advisers’ clients continue to have ongoing concerns about the current economic conditions and how they are impacting markets.

According to survey results, 89 per cent of advisers have some clients who adjusted their plans as a result of the rising cost-of-living. An increase from 53 per cent back in November last year.

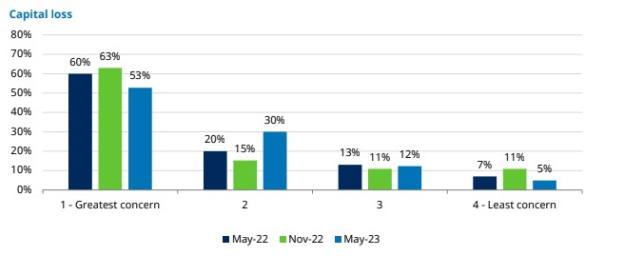

The research also found that advisers identified that capital loss remains the top ranking concern among clients. This had reduced since November 2022 but concerns around inflation saw a significant increase.

Speaking at a breakfast briefing yesterday, Doug Abbott, head of UK intermediary, said: "This is interesting because quite a lot the time we focus on the cost of living and rising rates and what the impact might be but clients of advisers tend to be slightly older, relatively well off and so on and so things like rising interest rates actually don't feature that highly when you talk to advisers about what they're talking to their clients about.

"But capital loss and the impacts of inflation come through as the two main areas they're concerned about."

Interest rates have continued to rise in recent times as the Bank of England battles inflation, with the base rate currently sitting at 4.5 per cent.

“What is clear from the results are the ongoing concerns held by clients due to the turbulent economic and geopolitical situation of the last year and the impact that is having on markets and potential capital loss,” Hepburn said.