Every adviser understands the importance of constructing diversified portfolios, yet very few genuinely diversifying investments are available to most UK investors. Winton’s James Gilbert highlights the difficulties “diversified” stock-bond portfolios faced in 2022, before introducing an alternative that is listed on all major platforms.

2022: When Conventional Investment Wisdom Broke

Constructing diversified investment portfolios has been straightforward for most of the past 20 years. Stocks have generally moved in the opposite direction to bonds, which meant that the two asset classes were diversifying for one another. For instance, during the Dotcom Bubble burst of the early 2000s, the 2008 Global Financial Crisis and the 2020 Covid outbreak, bond prices surged to mitigate investors’ losses in stocks.

This inverse relationship between the returns of stocks and bonds − combined with the rise of passive index-tracking investment products – meant that, until 2022, advisers could construct low-cost portfolios with attractive return characteristics by simply combining these two asset classes. Portfolios could then be tailored to an individual investor’s risk tolerance and investment horizon, by adjusting the ratio of “risky” stocks to “safe” bonds.

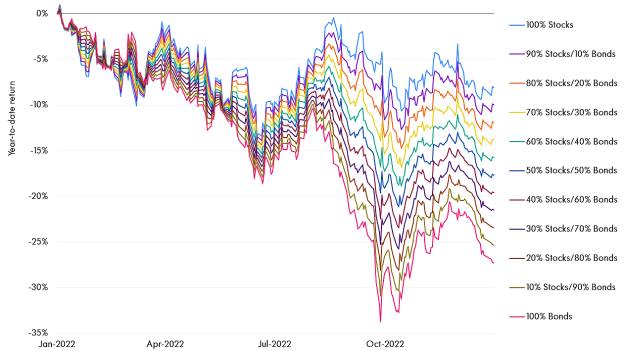

This approach to portfolio construction worked extraordinarily well in the years following the 2008 Global Financial Crisis. That is until 2022, when inflation rose to its highest levels in four decades and stocks and bonds fell together. What made matters worse for UK-based investors is that interest rates rose and “safe” bonds lost more than “risky” stocks.

Risk Ratings Reversed: Stock-Bond Portfolios in 2022

Source: Bloomberg, Winton, as at 31 December 2022. Stocks: MSCI All-Country World Index Net Total Return GBP; Bonds: Bloomberg Sterling Aggregate Total Return Index. Portfolio weights are set as at the start of the year and not rebalanced.

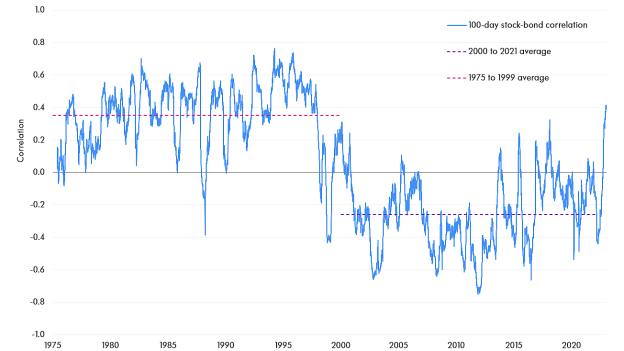

The return of stocks and bonds moving in lockstep – or exhibiting “positive correlation” – will not have surprised those with a longer-term perspective. If we look back to 1975, we can see that prior to 2000, positive correlation between stocks and bonds was the norm.

Stock-Bond Correlation Positive Before 2000

Source: Bloomberg, Winton, as at 31 December 2022. Equities: FTSE 100; Bonds: 10-year gilts.

Trend Following: A Genuine Alternative

Part of the challenge faced by UK investors is that access to genuine alternative investments has historically been limited to institutional investors and high-net-worth individuals. This is starting to change.

Take trend following, for example. The strategy − which seeks to profit from major price trends across commodities, currencies, stock indices and fixed income − is now available on all major UK investment platforms.

Many of the world’s largest institutional investors maintain an allocation to trend following and managers such as Winton have multi-decade track records. Part of the reason for this strategy’s success is that it has a long history of generating diversifying returns, particularly in difficult environments for traditional investment portfolios.

Trend following’s attractive properties were on show in 2022: the SG Trend Index, in which Societe Generale tracks the performance of the 10 largest strategies, rose 27.3% over the course of the year. Advisers who had included even a modest allocation to trend following in their clients’ portfolios will have seen the diversification benefits.

James Gilbert is Winton’s Head of Client Solutions

Find out more about trend following and the Winton Trend Fund (UCITS).